Friends of Branded!

Happy Saturday and I hope you had a great week!

Can you keep a secret? No really, can you? Schatzy likes to say that he can keep a secret, but it’s the people he tells that can’t. 😊

In all seriousness, despite the reports and headlines about the challenges in funding and how the spickets have been turned off with respect to capital flows, well, capital is in fact flowing.

I’m not saying the flows (remotely) match those of 2021, but deals are getting done and among the most active investors, few have changed their respective deal closings this year compared to last.

For all the writing I do about emerging foodservice & hospitality technology, innovation and brands (and yes, I write too much), I had a really fun week spending time with the emerging companies Branded is supporting as we work to bring these respective investments to a close.

So, for this week’s Top of the Fold, I want to shift the focus from hospitality operators (the folks Branded desperately wants to see win), and instead speak to the Founders of tech & innovation companies that are looking for capital (and we also want to see win).

Founders, friends, we know what you want and what you’re looking for: (i) capital and (ii) time (and if you can’t get our time, you’ll still be absolutely happy to take the capital).

Before diving in (and no Mr. Barton, I will not be inserting a random reference to an 80s movie here, although I do believe what I did just now is akin to breaking the 4th wall), I think it’s important to put some context or maybe guardrails around this investing topic. Specifically, since I believe it’s important to write about what you know, I’m using Branded’s early-stage investment thesis (Seed-Stage and Series Seed-Stage investments) as my point of reference. There are certainly similarities and commonalities across the spectrum of investing from the angel round to the IPO (and every stage in between), but Branded’s focus is on the Seed and Series Seed Stage, at least for now (IYKYK). 😊

I’ve got nothing but respect for venture capital’s big dogs and by that, I mean the renowned venture platforms that have been around for 20 years or more and have billions of assets under management. For these folks to move the proverbial ‘needle’ they need to make big bets and hit big winners. Again, respect!

Branded’s focus, as highlighted above, is primarily on emerging companies and I define that has companies with a minimally viable product (“MVP”) and at least some revenues (proof of concept).

I don’t know many venture platforms that claim to be “unicorn” hunters (a unicorn is company that reaches a billion-dollar valuation in a most aggressive / short time period), but I will say that Branded is NOT a “unicorn” hunter. Please don’t misunderstand, if we ever have a unicorn, I’ll be the first (after the Founder) to celebrate, but b/c the likelihood of unicorn success is incredibly low and not consistent with our operator-centric strategy, it's not something we look for and I dare say, even raises red flags for Branded if we feel that’s the path a Founder believes he / she needs to take.

Hospitality operators are among the most just-in-time (“JIT”) professionals of any industry I’ve ever seen and if our focus is on identifying technology & innovation that can help an operator today, then, by all means, unicorns become even less likely. Branded likes to invest in companies that are among the "one of a few" players in the given space. We don’t like “one of many” opportunities b/c we have concerns around the competition or saturation of players resulting in a race to the bottom when it comes to pricing. We also don’t like the “one & only,” b/c that is often far too much of a hit or miss scenario and also tends to lean on the need to change human behavior or define an entirely new category.

Don’t get me wrong, there have been incredibly successful companies that have changed human behavior. Starbucks changed human behavior by launching as a “third place,” a comfortable space between home (the first place) and work (the second place). Chipotle did it as well by making the “bowl” a new category within the fast-casual dining experience.

Both are amazing stories and wins, and both would have been hard companies for Branded to have embraced b/c of the uniqueness of their offering when they were coming to market.

Let’s get into the weeds, when Branded is introduced to a company for investment, we want to know / hear the following:

- What problem, challenge or opportunity are you solving for the operator?

- We want to learn about you (the founder) and your team and specifically your deputies.

- As a business to business (“B2B”) Software as a Service (“SaaS) investor, tell us about your tech and its scalability.

- How large is the addressable market you’re going after?

And now the equally important other side of the coin, the things we don’t want to hear (at least not hear in the first meeting):

- Who else has invested in your company. B/c I’m not relying on them for anything and dropping what you feel is an impressive name is not impressive.

- That you believe you’ve created a billion-dollar idea. B/c until you’ve made a few dollars, I don’t want to hear the “B Word.”

- That you will not need any more capital after this initial raise. B/c you will.

- That your estimates and projections are conservative. B/c they’re not.

Confidence is sexy, and hubris is ugly.

Founders. you’re asking for capital and ideally looking for strategic capital (which I define as investors that can bring more value to the company than just capital). I’ve never heard an investor say that they’re “dumb money” (and I know I never will). I have, however, often heard investors say that they're “strategic capital.” Despite the claim, it’s more often than not, the exception, as opposed to the rule that I see investors active with, and showing up for, their portfolio companies beyond investing capital (sorry, not sorry, but that’s been my experience).

Founders, friends, you need both capital and ideally time from your strategic investors who can help you reduce the time and cost of acquiring customers and ideally helping you secure additional capital.

Longstanding readers of the H^2 know my love of Milton Friedman and specifically his theory on the importance of self-interest (and that has nothing to do with being selfish). Everyone has their own self-interest and the beauty of that is that it’s yours (yours to set, yours to maintain and yours to change, if and whenever you want to). To have a successful relationship (professional or personal), self-interests need to be aligned and / or pull in the same direction.

Founders, you want capital and time from your investors. That’s your self-interest.

Your investors are financially motivated and incentivized to deliver superior returns to their investors. That’s their self-interest.

If they choose to invest in you, that’s a big deal and I hope you see it that way. It’s not their job to help you beyond that, but if you’ve cultivated and secured the right investors, they will in fact do just that. Your investors need results and exit outcomes and while an exit of your company may prove to be lifechanging for you, delivering superior results is what’s expected of them.

There’s a term in venture capital called “power law.” This law implies that most returns in a venture capital’s portfolio come from a tiny fraction of investments. In the spirit of the current major league baseball playoffs and specifically the American and National League Championship Series (which I know my Bostonian friends are fully enjoying, right JB?) the “power law” is akin to the “power hitter” which is defined by a batter that comes to the plate with an all-or-nothing approach.

Dave Kingman, who played for both the Mets & Yankees, led the National League in home runs twice (in 1979 and in 1982) and lead the majors in strikeouts (in 1972, 1979 and 1981).

There is nothing wrong with the “power law” (or “power hitter”) but like all things, the strategy needs to fit the expertise of the investment platform.

When I worked on Wall Street in the securitization market, I got to know investment managers that would “cut & run” when there was a sign of trouble and others that would “dig in” at those very same moments. Both had logical and strategic reasons for the actions they took.

The “cut & run” manager believed that given the large number of positions that comprised a securitization, allocating time to any one position was inefficient and that the time required to work out a bad loan, for example, was too costly relative to the size of the position and would come at the expense of the rest of the portfolio.

The “dig in” manager believed that the investment of time in the challenged position would produce a superior outcome on that single position and is where he would differentiate himself and his performance.

Again, both managers had rational, and logical reasons for the strategy they advanced.

The “power law” is therefore synonymous with the “cut & run” but only b/c it emphasizes the allocation of time and additional capital to the winners (and therefore, starving the ‘losers’ of these most desired commodities).

Branded has portfolio companies and they are not our children, but I’ve heard from many parents (with multiple children) that they allocate incremental time to the child who needs it most when they need it. Again, not my children, but I see a great deal of logic in this and will offer that Branded prides itself on digging in if we feel the help is warranted and only if we can, in fact, be helpful.

All the above is not to say that securing capital is easy, b/c it most certainly is not. However, investors like Branded, are looking for capital efficient models and businesses that address the most pressing issues operators are facing. Come to the table with a solution to a problem, challenge or opportunity that is important to the customer you’re trying to serve, be confident, and you’ll get the attention and ideally the capital and time you’re looking for!

It takes a village.

#1 Hospitality Podcast

Your go-to podcast for engaging conversations with hospitality's top leaders. Subscribe and never miss an episode!

The first shoutout this week goes to our partners at Leasecake, the markets leading lease & location management solution.

The entire Branded team wants to raise a glass to Leasecake not only on the closing of its $10mm Series A extension round, but for doing so with our friends from EMERGING, the leading growth equity fund for restaurant-entertainment concepts and restaurant technology.

When Branded talks about investors that represent strategic capital, the folks from EMERGING are exactly that and we're thrilled to have them be part of the Leasecake family!

You can read more about this in the press release here: The EMERGING Fund Backs Leasecake with Strategic Investment

For the remainder of Shoutout section, I want to share some thought leadership and specifically a few LinkedIn posts from friends & partners of Branded.

It's not lost on me that my own content tends to be a little lengthy (just a little), so I thought it would be refreshing to not only see who I'm following, and what I'm reading, but given these are all LinkedIn posts, by definition they're SHORT reads!

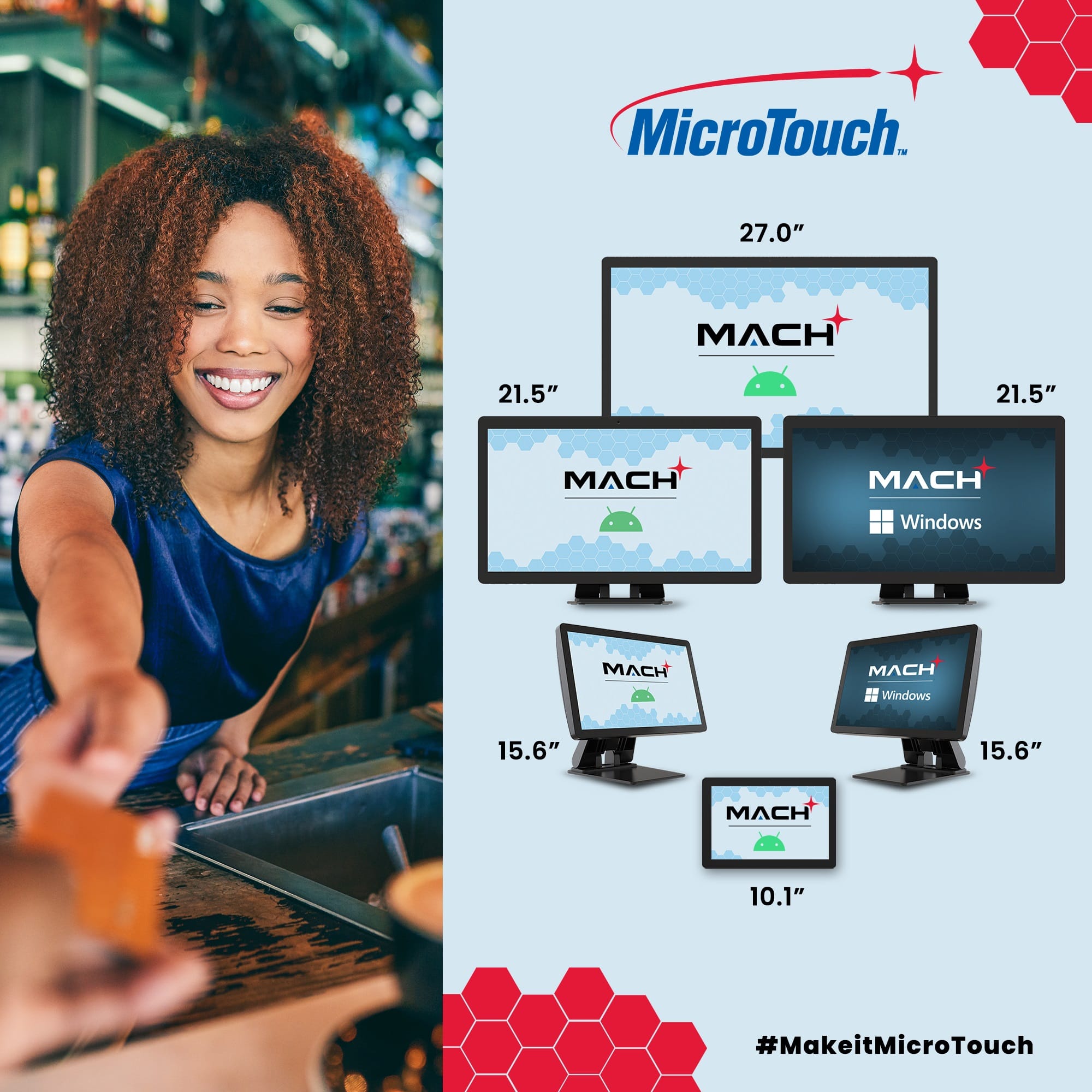

MicroTouch Mach AiO Family

Ideal for self-ordering QSR kiosks, interactive displays, kitchen display systems, & a range of applications in the hospitality environment.

Branded invites readers of the H^2 that are interested in learning more about our portfolio companies, and investment strategies to become part of our Access Hospitality Network.

This was an exciting week at Branded and as I wrote above, we have the privilege of working and supporting a number of tremendous companies in the B2B SaaS, and emerging restaurant space.

This week we shared some awesome updates on our friends at Big Chicken; LDV Hospitality; Craveworthy Brands; and the OG of guest engagement, Fishbowl.

We love sharing our insights on our portfolio companies with interested parties.

Please reach out to me directly if you'd like to discuss.

NYC Co-working Space

Seeking a premier co-working space in the heart of Gramercy, NYC? B Works fosters a community centered on strategic relationships, synergies, and innovative solutions. Elevate your growth—become a member today!

Featured Episode: Loyalty Programs & The North star of Successful Restaurant Marketing

Join Michael Schatzberg, “The Restaurant Guy,” and Jimmy Frischling, “The Finance Guy,” as they sit down with Julie Wade, the marketing mastermind behind Taziki’s Mediterranean Café. Julie shares how her passion for personalized hospitality is driving the brand’s success. At Taziki’s, it’s about more than just meals—it’s about creating meaningful connections with every guest. Julie reveals how this focus, combined with premium, fresh ingredients, sets Taziki’s apart from competitors.

Key highlights include:

- How personalized marketing is Taziki’s "North Star."

- Why Taziki’s offers high-end quality at fast-casual prices.

- Breaking news: New openings in Detroit and Texas signal big growth.

Plus, don’t miss the fun “Branded Quick-fire” games and deep reflections from Jimmy and Schatzy!

Tune in to hear the inside scoop on the future of hospitality and what’s next for Taziki’s!

Tune into the episode and subscribe to our channel here: Hospitality Hangout With Julie Wade

Re-Run of the Week:

Get ready to pull up a chair and dive into a conversation filled with inspiration and industry insights on the Hospitality Hangout Podcast! In this episode, Greg, the mastermind behind the world’s largest franchise operation, shares his journey from flipping burgers at McDonald’s to leading over 2,600 units across iconic brands like Applebee’s, Taco Bell, Panera, and more. Greg reveals the secret ingredients to his success: operational excellence, strategic diversification, and adapting to market trends.

This episode is packed with valuable lessons for anyone in the hospitality industry—don’t miss it!

Tune into the episode and subscribe to our channel here: Hospitality Hangout With Greg Flynn

You can tune in on:

Spotify: Click Here

Apple Podcasts: Click Here

Watch on YouTube: Click Here

Are you loving the Hospitality Hangout? Let us know! Please leave us a review here!

Create your restaurant’s AI profit engine

Unlock more profits and empower your team with AI.

TECHNOLOGY

Why Defining Minimum Deal Economics is Key to Hypergrowth Without Sacrificing Profitability

By: Seth Temko, Solutions Services Partner at Branded Hospitality Ventures

In the race for hypergrowth, software companies must avoid bad deals by defining minimum deal economics to maintain fiscal responsibility and long-term success.

MARKETING

BIGGEST TAKEAWAYS: Fast Casual Executive Summit Conference 2024

By: Rev Ciancio, Head of Revenue Marketing at Branded Hospitality Ventures

Fast Casual Executive Summit just concluded in Denver, CO. This is a show for proactive brands and proactive thinkers. They also have a built in dinner and networking event. If you want to make great connections, put it on your agenda for next year.

JOIN THE HEADLINE

Ready to showcase your ideas and insights?

Share your article with us for a chance to be featured in The Hospitality Headline!

We’re excited to spotlight diverse voices and spark meaningful discussions within our community. Submit your piece and let’s make your voice a headline!

That’s it for today!

See you next week, same bat-time, same bat-channel.

It takes a village!

Jimmy Frischling

Branded Hospitality Ventures

jimmy@brandedstrategic.com

235 Park Ave South, 4th Fl | New York, NY 10003

Branded Hospitality Ventures ("Branded") is an investment and solutions platform at the intersection of foodservice, technology, innovation and capital. As experienced hospitality owners and operators, Branded brings value to its partners through investment, strategic counsel, and its deep industry expertise and connections.

Learn more about Branded here: Branded At-A-Glance