Friends of Branded!

Happy Saturday and I hope you had a great week.

We’re in the final stretch of 2023 and while I expect things will quiet down as people start their holiday break, it continues to be busy here at Branded.

Last week I attended the Q4 board meeting of an asset management firm I’ve known and worked with for about the last 15 years. In connection with a new fund this platform is advancing, a comment was made about the nature of the "strategic investors" that were dominating the order book.

It was the word “strategic” that caught my attention and had me dig into what this type of investor meant to a later-stage investor than Branded.

First, I wonder how many investors feel the word “strategic” belongs next to their name. My searches for the definition of a “strategic investor” led me to many places, but universally, I believe the definition can be stated as an investor that provides guidance for growth & success, along with industry knowledge & connections that may greatly benefit your growing company.”

The most common thing I saw in connection with the definition of a "strategic investor" was that this is an investor that brings “more than just a check to the table.” Here again, I wonder how many investors want to be known as the folks that are “just bringing a check to the table.”

One definition I found made the argument that a strategic investor is usually a larger company and to that, my Branded sensibilities were offended (okay, only a little)!

I’m not suggesting that I don’t agree that the super vast majority of "strategic investors" we're fortunate to work with are in fact large companies, but I don’t want anyone to exclude Branded and the many other smaller "strategic investors" who we see doing amazing things in the industry from this category solely as a result of our size.

My point here is simply this, whether the business is a large fund manager working on later-stage opportunities, or a small manager working on early-stage and specifically emerging tech & innovation in the hospitality industry, there’s no question, “strategic investors” are the most desired and possibly the most active investors in the market right now.

My own definition of a “strategic investor” is one that is experienced in your industry and has insights and access to intel that is valuable to your company. The “strategic investor” has credibility and is a subject matter expert in your domain, has a network that will prove accretive to your business, and finally, has the ability to view your business from the perspective of an outsider, but are industry experts and therefore able to see expansive business opportunities beyond what you, as a founder & CEO, might see.

Regardless of your definition of a “strategic investor,” there’s one thing that is very clear to me, in this downturn of capital flows, that has left a record-breaking amount of capital on the sidelines as well as a record-breaking number of companies looking for capital, it’s the “strategic investors” that are stepping in to seize the day and to some extent, fill the void left as a result of the capital spickets being turned off from the “usual suspects.”

As I’ve written recently, 14 of Branded’s portfolio have tapped the capital markets over the last 15 months and 11 have done so on up-rounds for Branded. With multiples down across the board, it’s a reasonable assumption that no company secured an up-round as a result of a multiple appreciation and instead, had to do it the hard way, through sales growth and margin optimization.

I was reading this week about my nephew’s favorite burrito bowl company Chipotle or as Travis Kelce famously wrote in a Tweet that resulted in the renaming of a Kansas City location to "Chipolte," after this old Tweet was resurfaced, and specifically the investments the company made through its venture fund, Cultivate Next.

Quick side bar (and something I promised my wife and daughter I would include), if you have a problem with the relationship between Travis Kelce and Taylor Swift, then don’t be part of the relationship between Travis Kelce and Taylor Swift (b/c you’re not part of it anyway). I see two young, tremendously successful, talented, and good-looking people have come together. My opinion, God bless and good luck to them both.

Now back to Chipotle, via Cultivate Next invested in Greenfield Robotics and Nitricity. Both companies are focused on improving the farming industry. Greenfield Robotics is focused on making regenerative farming more efficient with the latest advances in AI, robotics and sensing technologies. Nitricty aims to tackle greenhouse gas emissions by creating fertilizer products that are better for fields, farmers, and the environment.

I’m moving away from the specific activities of Chipotle and it’s Cultivate Next, but not before acknowledging and giving credit for the tech-forward thinking this restaurant company continues to demonstrate and how it’s leveraging its role as a most “strategic investor” to address and even capitalize on the needs of its own business. Some companies lead and others follow. In the case of Chipotle, they’re without question among the strongest leaders in so many ways, and that includes in being tech-forward thinkers, operators, and investors.

Traditional VCs continue to engage with companies, but engagement and check writing are obviously completely different things. I’ve personally observed several VCs going through the motions and the process of performing diligence on companies, but not with much of any intention to invest.

And that’s where the importance and criticality of “strategic investors” comes into play. These are not investors who check in and check out or are there for you only in good times, but not in bad ones. When it comes to “strategic investors,” your industry is their industry and your commitment to identifying challenges, problems and opportunities is what these investors are looking for.

Emerging and early-stage companies represent what’s happening, to some extent, in the weeds and in the trenches. "Strategic investors" know the importance of staying informed, in the know and that emerging & early-stage companies are a source of R&D for these investors.

Of course no investor wants to be “just another check” and I expect every investor would like to be thought of as being a strategic one.

As Warren Buffet made famous, ”Only when the tide goes out do you learn who has been swimming naked.” My point here is not that "strategic investors" are better or worse than other investors, only that they’re commitment to an asset class and to working with emerging talent runs deep and, in an environment where capital flows are challenged, it’s the strategic folks that remain in the game and working to make their respective industry better.

To all the corporates that are engaging with emerging & early-stage companies and are active in the corporate venture capital space, we see you and we appreciate you. Even more importantly, we want to work with you in connection with the digital transformation going on in the hospitality and foodservice industry.

You might be big and Branded might be small, but we’re in the weeds of this industry and if you want to know what’s going on in the trenches, I expect we can be of help.

As always, it takes a village.

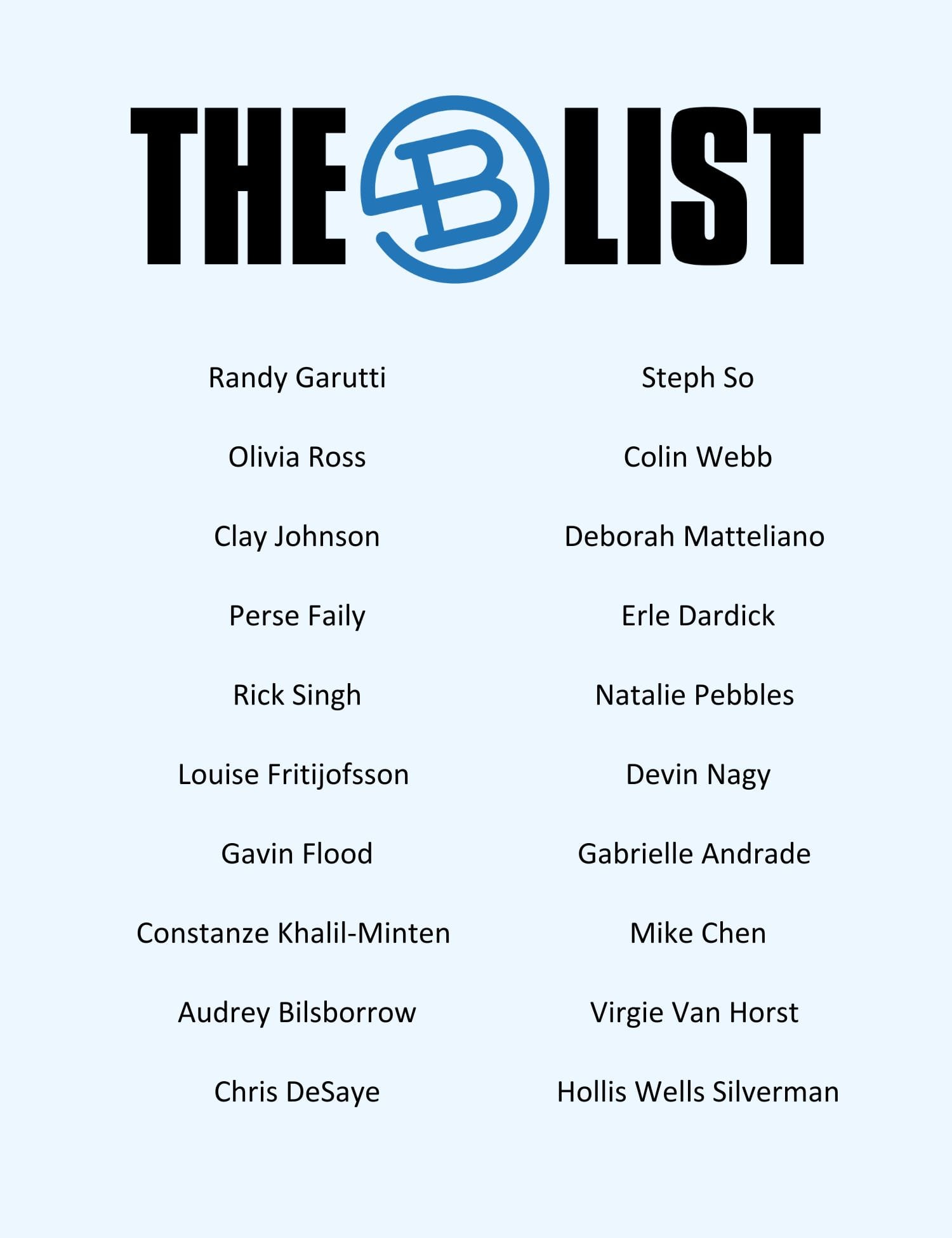

Readers of the Hospitality Headline, that are interested in learning more about Branded’s portfolio companies, investment strategies and future opportunities, are invited to explore becoming part of our Access Hospitality Network.

In this week's episode of Hospitality Hangout, Michael Schatzberg “The Restaurant Guy” and Jimmy Frischling “The Finance Guy” are joined by Prakash Karamchandani, Chief Executive Officer of Balance Pan-Asian Grille; Chris Medhurst, President and Chief Operating Officer of District Taco; and Chad Coulter, Founder and CEO of Biscuit Belly.

You can tune in on Spotify, Apple, Amazon, iHeart, or your favorite listening platform!

As far as Team Branded is concerned, if our portfolio companies are successfully making news as a result of the value they’re bringing to hospitality operators and contributing to the digital transformation going on in our industry, the least the H^2 can do is give them a little boost & boast!

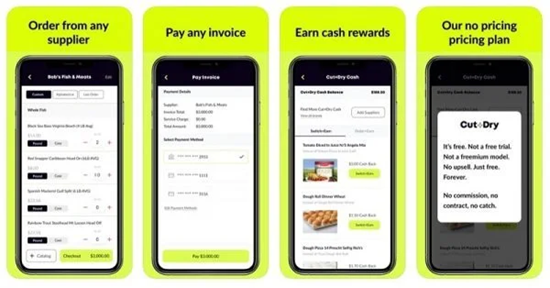

This week, our partners at Cut+Dry unveiled a revolutionary middleware platform that seamlessly integrates with both cloud and on-premise Foodservice ERPs and other Backend Systems. The Cut+Dry platform runs on WSO2's acclaimed Architecture and Integration Software

If you ask restaurant operators from any developed country, what the biggest and most challenging pain points are for restaurants, the answer will be (i) labor; and (ii) supply chain / procurement; or (i) supply chain / procurement and (ii) labor.

Yes, my answer might draw comparisons to Woody Harrelson’s thoughts on the 3 rules of real estate (location, location, location) in a discussion he had with Dr. Frazier Crane, where Woody concludes that “real estate people are stupid.”

Readers of the H^2 know my view about both the front and back of house. I understand that for readers who've been guests at restaurants, the front of house is where you live, what you see and what you care most about the most. For operators, the front of house is important (of course), but the back of house is where money is truly made and lost.

The hospitality industry is saturated with hundreds of Foodservice ERPs (Enterprise Resource Planning) and Backend Systems. For those less familiar with Foodservice ERPs, these are software systems that integrate various business processes and functions into a single unified platform. A strong ERP enables companies to streamline operators, improve efficiencies and enhance decision-making by providing real-time visibility and control over their resources.

According to an article I read as I was digging into what Cut+Dry has just done, by Michael Dautner on the importance of Food ERPs to the restaurant industry, “in the food industry, ERP can play a crucial role in managing the complex and dynamic nature of the business. From procurement to production, distribution, and sales, ERP systems can provide comprehensive solutions that address the unique challenges faced by food companies.” One of the most important challenges restaurant operators are facing is the need to optimize the supply chain by “facilitating seamless coordination between suppliers, manufacturers, distributors, and retailers.”

That what makes Cut+Dry’s middleware so unique, pivotal, and important.

Cut+Dry recognizes the need for streamlined connectivity in the modern Foodservice landscape. Their middleware platform bridges different backend systems and any internal or external applications that require integration. The platform distinguishes itself by offering clean APIs that enable real-time read / write capabilities, ensuring efficient and secure communication between applications and external systems.

According to Shanil Fernando, Chief Technology and AI Officer at Cut+Dry, “the Foodservice Industry has long struggled with hundreds of disconnected systems that hinder effective communication. Cut+Dry solves this problem once and for all. Now, any external app or platform can seamlessly communicate with any Foodservice ERP or other back-end system as effortlessly as developing an app on iOS or Android. While we initially plan to utilize the middleware platform exclusively for Cut+Dry Applications, we intend to open the APIs to external parties soon.”

Cut+Dry runs on WS02’s acclaimed Architecture and Integration Software. This launch marks a significant breakthrough, empowering Foodservice distributors to unlock cutting-edge customer-facing tools to boost sales, increase revenue, enhance efficiency, and elevate case volume.

According to Asanka Abeysinghe, Chief Technology Officer at WSO2. “WSO2 API Manager is a comprehensive platform that supports the entire API lifecycle, from creation to management, in environments ranging from cloud to on-premises. It enhances API strategy implementation, offering tools suited for designers, product managers, and end-users. Our proven success ensures that our API management and integration features will give Cut+Dry a robust foundation for their Foodservice industry integration platform.”

When friends asked me to what extent is technology involved in the restaurant business, I think a great deal about what companies like Cut+Dry are doing to help streamline and bring efficiencies to operators.

Operators, friends, with Cut+Dry, you will increase sales and improve your bottom line. Now that’s what I call an ally to the industry!

Sameer Kenkare at the top of the Monserrate, an iconic mountaintop that is 10k feet high and majestically floats above the city of Bogota, Colombia.

Mr. Kenkare, the Managing Partner, Corporate Venture Capital, Corporate Innovation and Startup Business Development at AWS, has been a Friend of Branded since our earliest days and a key person when it comes to the formation of the wonderful and strategic relationship Branded is so fortunate to have with the folks at AWS.

And for whatever its worth, any suggestion that Sameer winning this week's "WITW is Branded" contest, seems incredibly coincidental to our friend Mr. Steven Elinson's, Director at AWS for Travel & Hospitality, making his first appearance as a contributor to this week's edition of the H^2 and my goal of Branded getting additional attention from AWS is completely unfounded.

There's no coincidence here! It was all completely intentional! 😊

TODAY'S TRIVIA

Click here to see the answer!

TECHNOLOGY

The Tech Conundrum: Debunking the Assumption that Restaurants Can Thrive Without Technology

By: Steven Elinson, Director, AWS for Travel & Hospitality

I am frequently asked about the Buy vs Build decision that each brand must make (IE they all need technology). I always reflect back to the opportunities I had to directly interact with Dave Thomas (Wendy’s founder), Fred DeLuca (Subway founder), and George Biel (Houston’s/Hillstone founder) and how they would approach the application of technology into their beloved hospitality businesses.

Digital Restaurant Association

We champion restaurants to thrive in a digital world

BUSINESS

Your Human Network: Essential on Many Levels

By: Seth Temko, Solutions Services Partner at Branded Hospitality Ventures

You will encounter roadblocks, impasses, struggles, and challenges in your personal and professional life. Is your network of contacts who could possibly help you fresh enough that you would feel comfortable reaching out for help?

Donate to CORE this Giving Tuesday

CORE: Children of Restaurant Employees needs your help this Giving Tuesday! Giving Tuesday is an internationally recognized day of giving, and we're asking you to participate by making a donation to CORE - a nonprofit that provides financial relief to food & beverage service employees with children when they face a life-altering medical crisis or natural disaster. Will you show your support for qualifying restaurant families this Giving Tuesday? Learn more and donate by clicking the button below!

FINANCE

Beyond the Check: VCs Prepare for a Pivotal 2024

By: Julia Suchocki, Partner at Branded Hospitality Ventures

Venture Capitalists are ushering in 2024 with strategic shifts and a hands-on approach beyond traditional funding

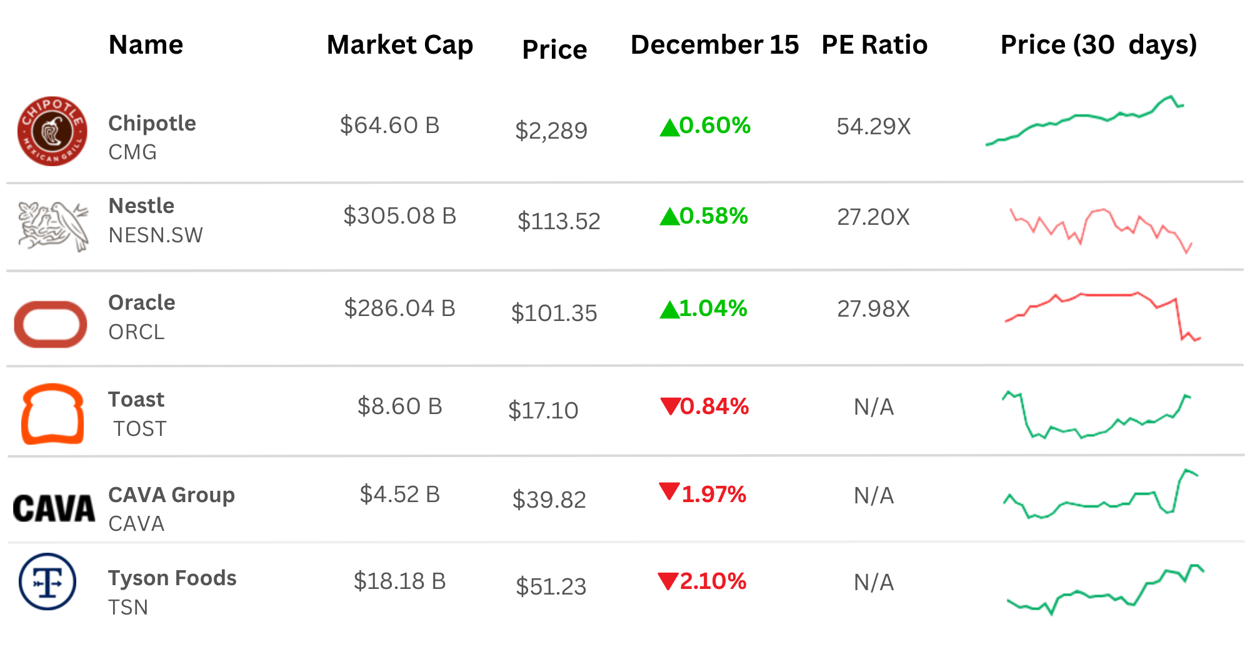

Restaurant Industry Movers in the Market

—Data as of 12/15/23

MAXIMIZE VALUE, IMPROVE PERFORMANCE

Learn how the Hospitality Industry advisors from CohnReznick can put you at the forefront of advanced financial, operational, and risk management strategies.

MARKETING

Turn Your Restaurant Marketing ON FIRE!!

By: Rev Ciancio, Head of Revenue Marketing at Branded Hospitality Ventures

Presenting The 2024 Digital Restaurant Association (DRA) Restaurant Marketing Summit, Powered by Branded!!!

IN THE NEWS

Hospitality Tech and F&B Innovation IN THE NEWS:

We love to highlight Food Service & Hospitality news, especially when it’s Partners & Friends making it

Cut + Dry: Cut+Dry Launches Groundbreaking Middleware Platform, Seamlessly Integrating with Any ERP and Backend System in Collaboration with WSO2 – The World’s Largest Middleware Bus PlatformBrizo FoodMetrics: Maximizing Business Growth with Restaurant Data LeadsOvation: Exploring Mental Health and Leadership in the Workplace With Dan SimonsLunchbox: The State of Restaurant Digital Payments in 2024 + 10 Expert Tips on How To Negotiate Credit Card Processing RatesLeasecake: Leasecake + Restaurant365 Integration: No Fuss FinanceIncentivio: Effective and Efficient Restaurant MarketingIncentivio: Mastering Digital Reputation Management in the Restaurant IndustryMeez: Menu Engineering: How to Increase Restaurant Profits in 2024Picnic: Rebel Robots: Dining Hall Pizza Goes High-Tech at Ole Miss

And in other News…please see some of the stories that caught our attention and that we’re paying attention to. This week was loaded with headlines and news!!

Fast Company: Map: 18 cities that led the way for new restaurant openings in 2023Inc: McDonald's Just Made a Huge Announcement. It Could Mean Big Trouble for StarbucksEntrepreneur: Kraft Heinz is a savory recipe for market successBusiness Insider: Pollo Campero wants to be the next chicken sensation in the US. The chain's vast menu is a mashup of the best at Chick-fil-A, Popeyes, and El Pollo Loco.The Wall Street Journal: Choice Hotels Launches Hostile Bid for WyndhamQSR Magazine: 20 Digital Disruptors Pushing the Restaurant Industry ForwardRestaurant Business Online: Shake Shack's C-suite will look different for the next phase of growthBloomberg: An AI Chatbot Will Take Your Order at More Wendy's Drive-ThrusRestaurant Business Online: Grubhub reveals the most popular takeout and delivery orders of 2023Men's Journal: Doritos Unveils Nacho Cheese-Flavored Liquor, and It Isn't CheapFast Company: Chipotle is investing in companies that make robots and fertilizer from artificial lightning

ANSWER: 43%

ASK THE HEADLINE

🔍 Got Questions? We've Got Answers! 🌟

Satisfy your thirst for knowledge? Look no further! It's time to dive into our brand-new segment: "Ask The Headline"! 🎉

📅 We'll be answering YOUR questions every week. And here's the best part: you can choose to stay anonymous or receive a fabulous shout-out when we feature your question!

That’s it for today!

See you next week, (about the) same bat-time, same bat-channel.

It takes a village!

Jimmy Frisch & Julia Suchocki

Branded Hospitality Ventures

jimmy@brandedstrategic.com & js@brandedstrategic.com

235 Park Ave South, 4th Fl | New York, NY 10003

Branded Hospitality Ventures ("Branded") is an investment and advisory platform at the intersection of food service, technology, innovation and capital. As experienced hospitality owners and operators, Branded brings value to its portfolio companies through investment, strategic counsel, and its deep industry expertise and connections.

Learn more about Branded here: Branded At-A-Glance December 2023