Friends of Branded!

Happy Saturday and I hope you had a great week.

We're starting off the Top of the Fold section this week a little differently and that's with an invitation for interested folks to take a look at our Access Hospitality Network!

Readers of the Hospitality Headline, that are interested in learning more about Branded’s portfolio companies, investment strategies and future opportunities, are invited to explore becoming part of our Access Hospitality Network.

Branded Hospitality Ventures is an investment platform that has closed two funds, completed eight co-directs (SPVs), manages two joint-ventures with family offices, has led 16 investment rounds and has three exits. We’re constantly in the market and always working to make 1 + 1 = 11 with industry folks as well as those interested in exploring this emerging asset class. Interested parties should click the link below to learn more.

And as long as we're doing new things this week and keeping it fresh, I'll share that we're launching a weekly contest (let's keep it classy and call it a "contest" as opposed to a "competition") where we'll feature a weekly photo that embodies the spirit of "Where in the World is Branded?"

Branded can't do anything without some artistic creativity (aka: a logo), so wait for it...okay...here it is!

The contest: Email marketing@brandedstrategic.com or contact your friend at Branded to submit a photo of yourself wearing a piece of Branded "swag" and let us know where in the world you are!

That's it. We like to keep things simple (Keep It Simple Schatzy).

Since there's no time like the present, I'll use this week's edition of the H^2 to announce that the first recipient of the WITWIB award goes to our friends Mike Damas and Mitchell Garreson with their submission all the way from the Union Square subway station (about 3 blocks from our office).

Let the record show, it's my prediction that this photo may (will) prove to be the one taken the closest to our HQ and B Works office of all future submissions! Closeness or distance from the office is NOT the driver of the winning photo, but it is certainly one of the factoids.

This photo was selected as I have a long history with my friend Mr. Damas and seeing him continue to work, embrace and develop 'new talent' is something I wanted to call attention to and recognize. Pay-it-forward people!

Now that I've got the new stuff taken care of, please allow me to get back to the job at hand and the opportunity to earn your time on a Saturday morning (or whenever you elect to read the H^2).

It was NOT random that today we announced, opened the doors and are inviting people to enter the void (that’s for you BH) and explore some of the investment activities Branded is engaging in. This has been a work in progress and as they say, timing is everything.

The end of Q2 2023 sparked an interesting moment in the financial markets and one that I believe is worth highlighting. We saw positive money flows and meaningful interest from investors in re-engaging with activity that had for some time been put on the shelves. 2021 started the reversal of fortune for many as money flows were halted abruptly and emerging companies that had been told to grow at all costs were now being told to focus on profitability. Was the 180-degrees turn on the part of investors a fair thing to do? Who said life was fair.

The image above of Gordon Gekko is all in good fun. I take no pleasure in watching the abrupt halting of money flows mess both people and companies up and see them go scrambling to shore up balance sheets and otherwise.

For avoidance of any doubt and b/c I pride myself on being a direct and unfiltered person, Branded wasn’t left unaffected by the violent turn in the capital markets. The change in market conditions cost us at least one exit we were working on for a portfolio company with a larger technology platform that shelved the acquisition b/c of the market volatility. We also lost an investment from a global hospitality company that was preparing to make a meaningful investment in our parent company and the change in money flows resulted in several commitments of capital to our second fund to get pulled.

These developments forced us to scramble both for ourselves as well as for several of our portfolio companies that we were working closely with to both invest in and help support their capital raising efforts. Did we get everything done we had aspired to do? No, we did not. But we were in the trenches with our portfolio companies and I’m proud to say that each one of them came out okay on the other side and in several cases, came out even stronger.

For me personally, this was a gut check moment, and some incredible relationships were formed, and I expect to call these folks my friends for the rest of my life. You learn a great deal about people when things are most challenging, and you learn quite a bit about yourself as well.

I was once asked if I had the necessary gas in the tank to take on my role with Branded. To be clear, I’ve always loved that question and my answer then, remains the same as it does now, “is water wet?”

With respect to all of the above, I’ll simply say that STUFF happens and when it does, you brush yourself off and keep moving forward.

My wife tells me I’m allowed to visit the grave, but I’m not allowed to camp out there. Keep moving forward!

It will not surprise my friends & family or even long-time readers of the H^2, but this calls for a Sly Stallone moment or rather, a Rocky Balboa quote about the importance and need to Keep Moving Forward

Experience is a good thing b/c knowledge is cumulative and education is expensive (and I’m not referring to the cost of a degree). Investment cycles can last anywhere from a few weeks to a number of years, and this solely depends on your point of view. A day-trader may see a number of cycles in a day, while a real estate investor may see cycles that last 15 to 20 years. Again, it’s in the eye of the beholder and always a function of one’s own self-interest.

As Q3 2023 was ending, we witnessed 3 large IPOs in the tech sector that collectively raised more than $6bn in less than a week and then watched with enthusiasm that Cisco Systems announced its intent to acquire cybersecurity software company Splunk for $28bn. It’s not lost on me that the Splunk valuation was something it hadn’t seen since 2021.

A few IPOs are understandably NOT often a cause for celebration, but as an investment platform focused on emerging technology & innovation in the hospitality industry, the opening up of the IPO market is welcomed, necessary and valued.

Branded knows and has positioned itself as an EARLIER-stage investor to the army of LATER-stage investors that are looking to deploy far larger amounts of capital in more mature companies. These later-stage of investors needs to see the opening of the IPO market as that represents an important point or North Star for these institutional firms that have capital to deploy. For those less familiar, the North Star symbolizes direction, guidance, stability, and purpose due to its fixed position relative to other stars.

We can debate and even trash-talk trickle-down economics, but when investing capital, the maturation curve and the oxygen or funding companies need to succeed will come from different sources and at different moments in time when the company reaches certain milestones. When there’s a kink in the armor or if a position along the investment curve is broken, it impacts all the others around it.

According to an article by MoneyWatch, and specifically Daniel Ives, an analyst with Wedbush Securities, Ives estimates that there’s $2 trillion to $3 trillion sitting on the sidelines, mostly held by Big Tech and private equity. Ives goes on to predict that “the biggest transformational spending wave that we’ve seen in 30 years, since the internet in 1995” is upon us. Mr. Ives puts a great deal of emphasis on the fascination with artificial intelligence and sees this moment as “the fourth industrial revolution that’s playing out, and its AI-driven. Strategically, companies can’t just sit around and wait. There’s a window where if they don’t get aggressive, they’ll miss out on this next wave.”

I feel like I can draw a reference to the character in the old SNL skit - Unfrozen Cavemen Lawyer at this moment.

Ladies and gentlemen of the jury, I’m just an early-stage investor. This $2 trillion and $3 trillion of capital on the sidelines confuses me. So much money, sitting on a sideline, this must be a pretty big sideline. I wonder how many people are needed to watch this amount of money. This world of high finance frightens me. Sometimes the honking of horns of traffic makes me want to get of my car and run off into the hills or whatever. 😊

You know what’s awesome about this amount of capital being on the sidelines and the thawing of the IPO market (that ‘frozen’ pun was intentional), it won’t just be big acquisitions and IPOs that re-open. We’re going to see the re-opening of markets and positive capital flows for younger and still early-stage companies.

Please don’t take my comments here to suggest that the pendulum is about to swing back to the days of capital flowing like a river and term sheets being submitted within minutes of presentations and demos being completed. Investors are going to return with greater and intentional discipline. Investors are looking at a market where valuations have been rationalized, protective provisions are favorable and quite simply, respect for capital is going to rule this next investment period. Growth at all costs is not going to be embraced, but clear and defined roadmaps to profitability are going to be the most important factor in determining which companies do and do not get funded.

For Branded, we’re sticking with our Vince Lombardi strategy, which means we’re going to keep running our Power Sweep until we need to change it. Our operator-first investment thesis will continue to rule the day. Emerging technology & innovation companies must deliver value and address the most important needs of operators.

This strategy allows Branded to focus on reducing the time and cost of customer acquisitions for our portfolio companies. Money can solve a lot of issues, but it can’t solve sales. There’s a famous principle called Parkinson’s Law, which essentially says, that expenses rise to meet income. So, if you are having a hard time paying your bills or making a dent in your mountain of debt, more money is likely NOT your answer. The point here is that money problems are most often caused by behavioral problems and behavioral problems can NOT be solved with money.

Branded is also moving forward with our efforts to support emerging restaurant brands. These are brands that have the DNA for growth and enterprise aspirations as well as an intentional commitment to technology and the connected kitchen.

When the pendulum swung violently in the beginning of 2022 and capital flows dried up and there was a great deal of pain to go around. Investors may at times have short memories, but these wounds are still fresh in their minds and as a result, the bar for securing capital will be high.

We will also see the DALBAR study present here as investor tends to buy when markets are high and sell when markets are low. They buy after a period of good performance and sell after a period of bad performance. All of this is to say that there will be hesitation on the part of investors, but I expect a reasonably strong finish to 2023 and a strong start to the year ahead.

Can I or will I guaranty this prediction. No, I can’t and won’t do that. I can tell you, however, that there are some strong operator-centric emerging technology & innovation companies that deserve time, attention, and capital. You want to know who they are? You now know what to do.

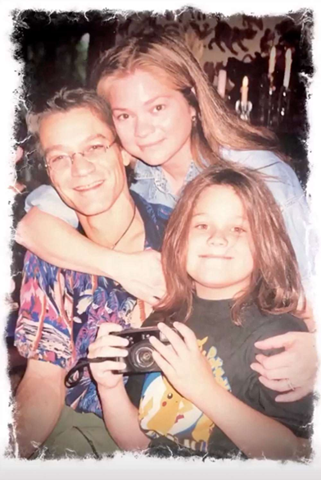

And finally, the image and title of this week's H^2. Eddie Van Halen and some lyrics from the song "Right Now." First the title, I think it's important to be present and I feel particularly emboldened by this moment and opportunities I intend to capture as we sprint into yearend. With the launch of Access Hospitality, I felt "Right Now" best captured where my head is at this week.

Selecting this title led me to the selected image, however, provided me with a gift and it was the finding of a blog by one Mr. Brian T. King and the piece he wrote titled “What Can We Learn from Eddie Van Halen?”

As I tell my young daughter, “Sharing is caring,” so I invite you to checkout Mr. King’s blog.

Eddie Van Halen is remembered for his legendary guitar skills, and I don't think it's a controversial statement to say he's among the greatest lead guitarists ever in a rock and roll band.

That said, it was Mr. King's words not about Eddie Van Halen’s mastery of the guitar that had me use the above photo (as well as the one below) in this week’s edition, but rather aspects of his life that inspired me to do that and I believe inspired Mr. King to write the blog post. For those that would prefer to skip the blog, Brian King wrote that "[Eddie] was one of those rare artists who taught all of us, artists or not, how to be better at what we do" which is to: (i) Love what you do; (ii) Continuously innovate and improve; and (iii) Embrace change.

Thank Mr. King and Mr. Eddie Van Halen for your words and inspiration respectively.

It takes a village!

In the spirit of capital flows and Branded’s enthusiasm for this alternative asset class that is emerging technology & innovation along with emerging restaurant brands, I first want to give a shoutout to our friend, peers and other investment platforms that continue to do great things in this industry we love.

I made a comment in last week’s edition where I referred to Mr. Danny Meyer as the "OG" when it comes to the embracement of technology, innovation and emerging brands that brings value to the hospitality industry.

I made the "OG" comment in part as a result of Enlightened Hospitality Investments and its mission to be the leading growth partners for people-driven companies and leveraging hospitality experts with its partners at Union Square Hospitality Group.

We appreciate the relationship Branded has with this amazing team and specifically our peers who we also get to call our friends, Mark Leavitt, Pete Mavrovitis and Harry Seherr-Thoss.

So why the shoutout this week? Great question.

Branded’s office and our co-working space, B Works, are located in the Union Square neighborhood. We work just a few floors above Union Square Café which took over the space that was the home of one of Branded’s very first restaurants, City Crab & Seafood Company. City Crab occupied the space for over 2-decades and closed in connection with Mr. Meyer wanting to re-open Union Square Café in this location.

We believe in USHG’s commitment to outstanding hospitality, their loyalty to New York City and specifically to Union Square Park.

Last week, USHG announced their new logo and while it’s THEIR logo, it means a lot to the Branded Team, as we share this neighborhood and their love of Union Square Park!

I want to make a second shoutout to our peers and friends at EMERGING and the announcement about their new fund: New investment group sets sights on promising tech and eatertainment

Why am I using real estate in Branded’s H^2 newsletter to highlight and give a shoutout to a platform that many might believe is a competitor of Branded?

B/c that’s not how I view Mathew Focht, David Bagley and the crew at EMERGING. To the contrary, these are our peers, our friends and this asset class needs more outstanding professionals and industry experts to help bring attention to the transformation and specifically the digitization and democratization going on in the hospitality industry.

I’m going to call this the “Steve Simoni theory.” Steve was a founder at Bbot which was one of Branded’s earliest investments and our first exit when it was acquired by DoorDash (sorry Yaniv, you were a close second when GoParrot acquired by Square, but you were still our second exit). 😊

The Steve Simoni theory (which I literally named today and did so without permission or even informing Mr. Simoni that I’ve done this), was derived from something he said to me early in our relationship and when Bbot was still VERY early in its own maturation.

I watched Steve help his peers and folks that could have been seen as his direct competitors. He'd share insights with for them, offer support to them and recommend them to operators that he felt would benefit from working with these competitors. When I asked him why he was doing all this, he explained that Bbot was charting and advancing in unchartered waters and needed engagement and adoption from operators and guests.

We both agreed that the hospitality industry is enormous, fragmented and there would never be a one-size-fits-all solution for any opportunity, problem or challenge. Bbot needed these other players to succeed and to make the use of QR codes and the empowering of guests to order & pay with their smartphones common and completely mainstream. I think of Steve’s words as a modern day “rising tides lifts all boats.”

Now back to EMERGING, first, I don’t see them or our friends at EHI as competitors. Each of our platforms has their own investment thesis and strategy. Each also invests in different points of the maturation curve. Second, if I did consider them as competitors, then I’d elicit the Steve Simoni theory and want these friends to be successful b/c their success will bring more attention, institutional awareness and capital to this alternative asset class, and BRANDED (like EHI and EMERGING) believes this asset class deserves more attention, institutional awareness and capital.

Finally, yes, finally, this last shoutout goes to our friends at Networld Media Group and the Fast Casual Summit taking place in Louisville, KY, starting tomorrow afternoon (yes JD, it’s time for some Kentucky water 😊)!

Readers of the H^2 know the Branded loves conferences and in-person events. The Fast Casual Executive Summit has been an event that we hit each and every year and it’s led to so many incredible relationships, opportunities and success stories.

The Branded Team wants to give a special shoutout to our friends Kathy Doyle, Cherryh Cansler and the entire team at Networld Media for always making Branded and the entire group of attendees so welcomed at your events.

Being hospitable is NOT exclusive to the restaurant industry and in fact, I believe it's something that EVERY single business and industry needs to embrace and strive to succeed at. The Networld Media Group and the team that drives the Fast Casual Executive Summit exudes and demonstrates hospitality at all their events and I believe that continues to be their ‘not-secret-sauce’ and the key reason why the attendee list continues to be so strong.

We appreciate the Networld Media Group, value this relationship and are proud to once again be part of the Fast Casual Executive Summit and of course, bring our Hospitality Hangout podcast down to Louisville for a special on the road edition!

At the risk of highlighting a few and coming up short to recognize many, here are a few of the speakers Branded is super excited to see in action.

TODAY'S TRIVIA

Answer also revealed at the end of the newsletter

TECHNOLOGY

"Yes, Chef"

By: Julia Suchocki, Partner at Branded Hospitality Ventures

Becoming a chef is no cakewalk (pun intended). It's a title that's earned through countless hours of sweat, blood, and sometimes even tears. So when a chef gives you a command, you believe in his expertise and trust that he's leading you to success. "Yes, chef" isn't just a formality; it's a nod of respect to the authority figure at the helm and a symbol of unity within a team working tirelessly to achieve a common culinary masterpiece. Now imagine having you're own sidekick who can make you more efficient? Enter "Yes, Chef" Read More

Digital Restaurant Association

We champion restaurants to thrive in a digital world

FINANCE

A Strategic Shift: SpotOn Sells Sports and Entertainment Division to Shift4

By: Julia Suchocki, Partner at Branded Hospitality Ventures

In a recent twist of events, SpotOn, a leading player in the restaurant technology landscape, has made headlines by selling its sports and entertainment division to Shift4 for $100M. This strategic move has left many in the industry wondering what's next for the firm and why the big move. Read More

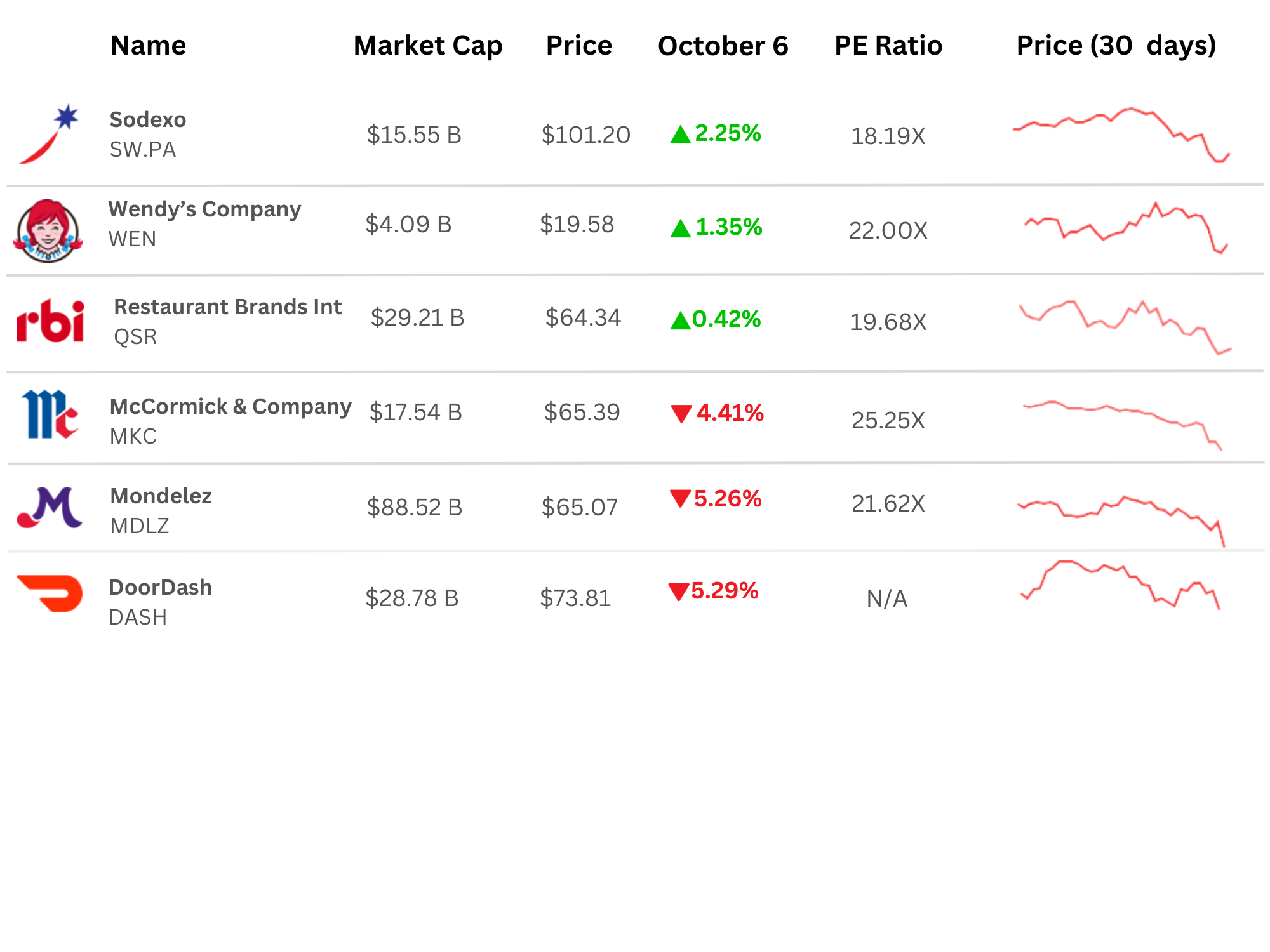

Restaurant Industry Movers in the Market

—Data as of 10/6/23

BUSINESS

Four Time-Tested Business Tips From Building A Successful Restaurant

By: Bo Davis, CEO at MarginEdge

What’s a rarely revealed restaurant industry secret? Even highly successful establishments and celebrity restaurateurs stress over margins, costs, staff and profitable operations. While post-pandemic diners have enthusiastically returned to the table, it’s still a roller coaster ride. The National Restaurant Association forecasts $997 billion in 2023 sales and the addition of 500,000 new food service jobs. Cold as a proper gazpacho soup, however, is the fact that it remains a challenging industry, with first-year failure rates between 20%-30% and ongoing viability buffeted by a buffet of factors. Read More

MAXIMIZE VALUE, IMPROVE PERFORMANCE

Learn how the Hospitality Industry advisors from CohnReznick can put you at the forefront of advanced financial, operational, and risk management strategies.

MARKETING

Restaurant Marketing Hacks That the Big Brands Don't Want You to Know About

By: Rev Ciancio, Head of Revenue Marketing at Branded Hospitality Ventures

I just got back from the Pizza & Pasta Northeast in Atlantic City, NJ. Normally, I would share some key takeaways after a trade show, but I’m gonna do this one a little differently. I got asked a lot of questions about restaurant marketing and tech, so here are a few of my top easy to execute marketing tips tricks and tactics shared or learned at the show. Read More

PODCAST

Hospitality Hangout with Scott Boatwright, COO of Chipotle Mexican Grill

IN THE NEWS

Hospitality Tech and F&B Innovation IN THE NEWS:

We love to highlight Food Service & Hospitality news, especially when it’s Partners & Friends making it!

- GoTab: Sips by the Shore- The Power of Hotel Mobile Ordering

- Par: PAR Technology Corporation Has Entered into An Exclusive Unified Point-of-Sale Agreement

- Incentivio: Building A Restaurant Website: A Guide

- Ovation: How to Connect Rather Than Transact With Lisa Miller

- Hone: Restaurant Book Keeping Explained

- Yumpingo: How Yard and Coop bring the customer into the decision-making process

- Spendgo: Selecting the Ideal Loyalty Provider for Your Restaurant

- Marginedge: Accounting dashboards help keep your restaurant on track

- Leasecake: The Definitive Guide to Lease Management for Franchisees

And in other News…please see some of the stories that caught our attention and that we’re paying attention to. This week was loaded with headlines and news!!

- FSR Magazine: These are the Most-Beloved Restaurant Brands in America

- Restaurant Business: SpotOn sells sports and entertainment division to Shift4

- Restaurant Dive: An inside look at Red Robin’s menu revamp

- Restaurant Dive: Domino’s, Microsoft partner to bring AI to restaurants, online ordering

- Food Business News: Krispy Kreme puts Insomnia Cookies on the block

- Business Insider: Little Caesars knows what you're going to order before you do. With AI tools, soon more restaurants will

- Restaurant Business: DoorDash is testing rewards for customers who dine out

- Forbes: Five Qualities In A Tech Startup CEO That Investors Are Looking For

ANSWER: Friday

The most popular night for food delivery and takeout is Friday. Saturday is a close second, followed by Thursday.. Then Sunday.

ASK THE HEADLINE

🔍 Got Questions? We've Got Answers! 🌟

Satisfy your thirst for knowledge? Look no further! It's time to dive into our brand-new segment: "Ask The Headline"! 🎉

📅 We'll be answering YOUR questions every week. And here's the best part: you can choose to stay anonymous or receive a fabulous shout-out when we feature your question!

That’s it for today!

See you next week, (about the) same bat-time, same bat-channel.

It takes a village!

Jimmy Frisch & Julia Suchocki

Branded Hospitality Ventures

jimmy@brandedstrategic.com & js@brandedstrategic.com

235 Park Ave South, 4th Fl | New York, NY 10003

Branded Hospitality Ventures ("Branded") is an investment and advisory platform at the intersection of food service, technology, innovation and capital. As experienced hospitality owners and operators, Branded brings value to its portfolio companies through investment, strategic counsel, and its deep industry expertise and connections.

Learn more about Branded here: Branded At-A-Glance October 2023