Friends of Branded!

Happy Saturday and I hope you had a great week!

ESG companies, which refers to businesses that emphasize Environmental, Social and Governance (“ESG”) principles in their strategies and operations are important b/c they address the pressing global challenges while promoting sustainable and ethical business practices.

These are companies that prioritize sustainability and ethical practices and are expected to be attractive to investors as well as consumers that are looking for responsible corporate behavior.

Respect, agreed, and all the above is great!

Now the money shot and some unsolicited advice to ESG Companies looking to raise capital - don’t lead with your ESG value proposition.

Instead, lead with your business model, how you’re deliver value to your customers, how you're going to make money as a business, and most importantly, how you’re going to deliver strong returns to your investors.

AFTER, and for emphasis, only AFTER you’ve made the roadmap to delivering strong returns to your potential stakeholders clear, should you dive into the ESG component of your business.

No, I’m not in a bad mood as we kick off this weekend before the Thanksgiving Holiday and to the contrary, I’m in a great mood.

My theme for Top of the Fold this week is completely reality-based.

For Branded Hospitality, 2024 has been a year of ‘special situations’ where we both invested and helped to promote companies that are of course operator-centric, where we believe we have the potential to deliver strong returns, and each company we worked with also has a unique story to tell (value-add) about their respective position in the market.

Some of our 2024 activity includes investments into Shaquille O’Neal’s & Josh Halpern's Big Chicken (emerging QSR restaurant company), John Meadow’s LDV Hospitality, (expanding FSR restaurant company) Wigg’s Civitillo’s Starfish (food traceability), Benjamin Duvall & Brian Goldberg’s Mr Bing (East Asian Street Sauces), and now Adam Ochstein’s Fishbowl (the OG of guest engagement). You'll need to go down to the Shoutout section to learn about Fishbowl!

For avoidance of any doubt, none of the above companies represent ESG platforms and that shouldn’t remotely suggest that these aren’t great people, who care deeply about their teams, operating ethical businesses and most importantly, are all driven to deliver returns to their stakeholders.

ESG is AWESOME and as a graduate of Wesleyan University (the inspiration behind the 1994 comedy, PCU), I place a big value on the importance of companies doing the right things for the environment and that emphasize inclusive practices.

Branded looks for and leans into companies that aspire to address environmental issues such as energy efficiency, carbon emissions, waste management, and water conservation. We believe in the importance of companies having a positive relationship with its employees, customers, and the community they serve. This includes, but isn’t limited to employee welfare & diversity, community engagement, product safety & quality, and supply chains ethics.

So, with all this enthusiasm and I dare say pride in embracing ESG companies, why am I telling ESG companies NOT to lead with this clear value-add? It’s b/c this is not what will drive capital to your company and b/c you’re not leading with the one thing that investors care most about, a return on their invested capital.

Time for a story and a second opportunity to mention Lin Manuel Miranda’s alma mater, Wesleyan!

In the very early-days of Branded’s business, we owned a seafood restaurant, and I was contacted by a Wesleyan alum that had launched a logistics & marketplace platform whose mission it was to help fish farmers by connecting them directly with restaurants. Seems like an idea worth exploring, a platform that connects fish-sellers directly with fish-buyers and cuts out the middleman (sorry, middleperson, this is a Wesleyan story). 😊

The pitch led with the challenges of how the current and longstanding seafood supply chain operated and how it disadvantaged the fishermen (damn it, fisherpersons). This marketplace would connect these fish farmers directly with hospitality operators.

I had the GM of the restaurant at the meeting and there was interest, until there wasn’t.

How much money would the restaurant save by disrupting its longstanding relationship with our seafood distributor and moving to this new marketplace? Nothing was the answer. Our restaurant wouldn’t save any money as a result of this change.

Would this new marketplace be as reliable and meet the needs of our restaurants, my GM asked. The new marketplace wouldn’t be as reliable and in fact, would be somewhat volatile based on the success at any given time by the fish farmers and what they caught and therefore could supply.

No savings and a supply chain that would be less reliable. My GM asked if he could donate to a charity that would benefit fish farmers and return to his work.

While the story about this emerging seafood marketplace and the plight of the fishermen made me think of Billy’s Joel’s 1989 song called “The Downeaster ‘Alexa’” that highlights the challenges faced by fishermen on his album Storm Front (back then you had to purchaser the whole album or CD) as a result of the economic and environmental conditions, I couldn’t disagree with the lack of interest in this platform by our GM.

Billy Joe’s song is a tribute to the hardworking fishing communities of the northeastern US and that is an industry that continues to be plagued by a shrinking fish population and tighter regulations, but that doesn’t justify asking another business (or industry) to shoulder the costs or put its supply chain at risk.

Okay, so that intended short story about an emerging seafood marketplace wasn’t so short (was the Billy Joel part really needed? Please don’t answer that), but my point was that despite the good intentions of the platform, the business model and specifically the opportunity to deliver returns to investors was non-existent.

Branded doesn’t just like the idea of ESG companies, we’ve invested in several and continue to love solid business plans where we see the potential to earn an attractive risk adjust return also helps support companies doing good things for the environment and community I which they reside.

Take for example our friends and partners at Dispatch Good, a logistics platform that allows restaurants to save money and elevate their brand image by reusing packaging. I remember when we first discussed this company with some investors, and they reacted negatively to the idea of having previously used packaging be part of their delivery or takeaway.

You know what doesn’t have a single use, every piece of flatware, plateware, and glassware you use in a restaurant. You know why they're safe to use? It’s called a dishwasher.

The surge in off-premises dining (delivery & takeaway) has led to food packaging now making up nearly 50% of municipal solid waste in the US with much of it ending up in landfills. This trend was amplified during the pandemic, but with the demand for off-premises dining remaining high, and recycling rates and the use of non-biodegradable materials remaining low, this waste from off-premises dining continues to contribute heavily to landfills.

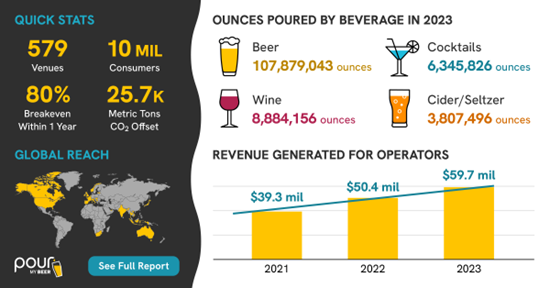

You what Branded portfolio company is a stealth ESG company, PourMyBeer / PourMyBev (collectively “PMB”)!

That’s right, this company that can reduce overhead by 75%, boost sales volume by 50% and has a fast-track to a ROI within a year, also eliminates waste.

In Europe and in particular, in the European Union, regulations have been implemented to reduce the environmental impact of single-serve beverage containers. Under the Single-Use Plastics Directive (“SUPD”), plastic caps on beverage containers of 3 liters or less must remain attached to the bottle after opening. This measure aims to reduce litter and promote recycling by ensuring that caps are retained with the bottle. Additionally, the Packaging and Packaging Waste Regulation (“PPWR”) aims to transition towards a circular economy by encouraging manufacturers to use more sustainable packaging solutions and reduce the use of single-use plastics.

With PMBs self-pour solution, Branded’s friends at Coca-Cola Europacific Partners saw the value in a system that encouraged customers & guests to use their own beverage containers (and make sure hospitality venues were compensated for every ounce poured).

To see the Full Impact Report, click here: The Impact of PourMyBeer in the Self-Pour Beverage Market

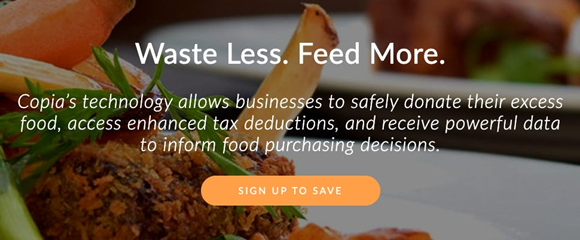

Branded most significant investment in a company that delivers economic value to its customers, and we expect will do the same for its stakeholders, that falls into the ESG category is Copia.

Copia is the first fully automated waste tracking, prevention, and surplus redistribution platform. Businesses love working with Copia b/c they can earn an enhanced tax deduction by up to 2x the cost basis of its food.

Throwing away food isn’t free; hospitality venues must pay a waste disposal company to hall the garbage away. Donating food in a compliant manner generates an enhanced tax deduction. You know what else that does, it reduces food waste, helps feed neighbors in need (the average deliver of Copia’s donated food is 7 miles from the source of the donation), and is good for the planet (11% of the world’s greenhouse gas is from wasting food and 24% of US landfills are made up of wasted food).

You know how many Americans are food insecure? About 50mm! Food waste is a $408 billion problem (annual loss from wasting food in the US).

To be clear, Branded loves what Copia is doing to address the issues around food insecurity, this nearly half a trillion problem with food waste and to support reducing greenhouse gas and landfills, but it’s the enhanced tax deductions that got us excited as we expect that's what’s proving to be most attractive to its customers and will deliver attractive returns to Copia’s stakeholders.

If you’d like to learn a little bit more about Copia, you can do so here: Copia-at-a-Glance

We also may or may not have a guest contributor to the H^2 this week in the Shoutout section (spoiler alert, we do and it's Kimberly Smith, the CEO of Copia).

It’s not a bad thing to do well, and to do good things at the same time. In fact, it's an awesome thing!

ESG companies are important for so many reasons, but any company, no matter how good they may be, must approach investors with the understanding of their self-interest and that’s to first and foremost help them make money for their partners.

That’s one of the Godfather Rule’s I do believe is not only most important but must be respected.

Now leave the gun. Take the cannoli. And have a Happy Thanksgiving next week!

It takes a village.

#1 Hospitality Podcast

Your go-to podcast for engaging conversations with hospitality's top leaders. Subscribe and never miss an episode!

This was a fun-filled and action-packed week (sounds like the preview to a movie) and I’ve got a few shoutouts to give! Yup, just a few this week!

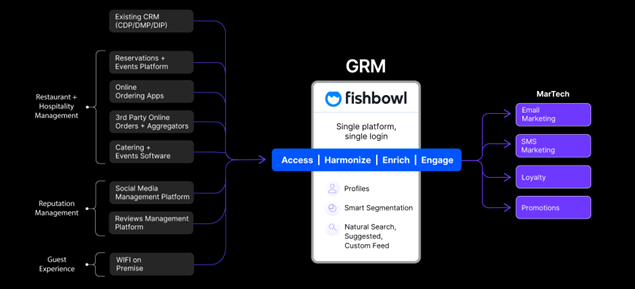

Shoutout #1 this week goes to Branded’s newest portfolio company, the OG of guest engagement and the single best way for hospitality operators to connect with their guests, Fishbowl.

Branded was an early adopter of this B2B SaaS platform over two decades ago and we’ve been super impressed at how this company under the leadership of our friend and now partner, Mr. Adam Ochstein, along with the entire Fishbowl team, has worked to modernize its offering.

Guest engagement, personalization, and understanding your guests is one of the most important factoids that is proving to separate the winners from the losers in this fiercely competitive industry.

With Fishbowl, restaurant operators can supercharge its ROI by enhancing guest insights with its Customer Data Platform, Customer Relationship Management system and marketing automation solutions, that are built exclusively for restaurants!

Branded so respects and appreciates how Fishbowl understands restaurants. They know we make money by serving customers, but we maximize value by treating them as guests.

Fishbowl 1.0 was the OG of e-mail marketing almost 25 years ago. Fishbowl 2.0 introduced digital offers and loyalty and now Fishbowl 3.0 is helping restaurants through the power of guest data.

Fishbowl’s newly redesigned best-in-class Guest Relationship Management (“GRM”) platform has revitalized the company and positioned it for accelerated growth. The product offering now allows restaurants to personalize marketing campaigns and improve guest experiences from central repository of more than 150mm guests in its database. Not to get too granular, but Branded believes the revenue from the rollout of these new product features to new customers and its 50,000 current restaurant customers is only beginning to be realized.

It’s not lost on me that on Oct 4th, Branded invested into a company that was formed on October 4th, is pre-revenue and represents the youngest company we’ve ever gotten behind (hello Starfish). This week we invested into a 25-year-old company, with over 50k customers and has undergone a most meaningful modernization.

Yes, 2024 has been the year of special situations, and unique opportunities that were anything other than business as usual.

That why we play this sport we love!

Welcome to the Branded Family Fishbowl and as you know, we go to the mattresses for our friends & partners!

Shoutout #2 this week goes to our friends and partners at Copia.

Yes, I believe in authenticity and intentionality and there was nothing unintentional about this week’s Top of the Fold.

When my friend and Copia’s CEO, Kimberly Smith, shared an article with me that she’s been working on, I asked if I could publish it in this week’s H^2. I of course love having guest contributors to this newsletter, but it was Kimberly’s article that was the genesis of the Top of the Fold theme.

You can read Kimberly's article here: Waste - an Overlooked Asset: Unleashing Hidden Profits in Foodservice Businesses

But it wasn’t just the article that got me excited about the great work Copia is doing for hospitality operators, it’s also who has recently signed on to work with this company.

Friend of Branded and one of the truly special companies in our industry, Jose Andres Group has signed on as a customer with Copia.

To be clear, I subscribe to sometimes asking for permission while at other times asking for forgiveness. In connection with this announcement, I fully admit that I sought permission from Mr. Sam Bakhshandehpour (as I told him, he’s a tall drink of water, an impressive person and I’m a little intimidated, so I asked for permission to include JAG in this Shoutout!). 😊

In all seriousness, if you believe you’re (at least somewhat) judged by the company you keep, I take great pride in the coming together of Copia and Jose Andres Group.

All of the above would have been enough (Kenough!), but I also get to share that The ONE Group and specifically its Benihana brand (a favorite restaurant of my brother Heavy T) has also signed on to be part of the Copia family.

I look forward each year to enjoying The ONE Group’s culinary offering at the annual ICR conference and this year I’ll have something extra to celebrate with our friends down in Orlando as they’re embracing Copia.

Shoutout #3 this week goes to our friends and partners at Brizo FoodMetrics. Branded is admittedly biased, but we believe Brizo offers access to the freshest, most comprehensive foodservice insights on the market.

This week, Brizo unveiled its fully redesigned Brizo FoodMetrics platform, and I wanted to share this news with the H^2 community.

You can read update Brizo’s platform here: The Next Generation of Brizo FoodMetrics is Here

And finally, yes, finally, Shoutout #4 goes to our friends and partners at Toast.

Toast this week put up some impressive quarterly numbers and you can read about it here: Toast’s stock soars after company swings to profit and revenue beats estimates

My partner, Mr. Michael “Schatzy” Schatzberg had his own spin on Toast’s strong performance and might have drawn a correlation to actions Toast and Branded took together recently and Toast’s success.

I’m not ready to reach the same conclusion as Schatzy, but that doesn’t mean we won't raise a glass to our friends at Toast and celebrate their success!

The POS That Grows with You

PAR POS scales with you, cutting wait times and boosting service quality. Plus, 300+ integrations ensure your tech stack can evolve without compromises.

Branded invites readers of the H^2 that are interested in learning more about our portfolio companies, and investment strategies to become part of our Access Hospitality Network.

NYC Co-working Space

Seeking a premier co-working space in the heart of Gramercy, NYC? B Works fosters a community centered on strategic relationships, synergies, and innovative solutions. Elevate your growth—become a member today!

Featured Episode: Tiki Taco a “Hometown Hero” Scaling Up

Join Michael Schatzberg, “The Restaurant Guy,” and Jimmy Frischling, “The Finance Guy,” In our latest Hospitality Hangout episode, with Eric Knott, CEO of Tiki Taco. Eric shares how a clear vision, intentional technology, and community-first leadership have helped the brand grow while maintaining its authenticity. He discusses the importance of creating a balanced tech stack that addresses real-world challenges for guests, staff, and leadership, and weighs the benefits of integrated solutions versus all-in-one systems.

As Tiki Taco prepares to expand beyond its three Kansas City locations, Eric highlights the importance of staying true to the brand’s “taste of home” identity. He also emphasizes the key role of community support, with Tiki Taco actively donating to local schools and organizations, a practice he believes is essential for sustainable growth as the brand enters new markets. Looking ahead, Tiki Taco plans to add four to five new locations next year, staying committed to the core elements of great food, service, and atmosphere.

Tune into the episode and subscribe to our channel here: Hospitality Hangout With Eric Knott

Re-Run of the Week:

In this special Super Bowl Re-Run episode of Hospitality Hangout, Michael Schatzberg “The Restaurant Guy” and Jimmy Frischling “The Finance Guy” chat with Dave Harris, CIO/CTO at Shake Shack. We’re excited to share the news that Shake Shack is now offered on Delta flights, elevating in-flight dining with their beloved, high-quality menu items. This exciting partnership brings one of America’s most iconic fast-casual brands to the skies, offering travelers a unique culinary experience that bridges comfort and innovation.

In light of this news, we’re revisiting one of our favorite podcast episodes featuring Dave Harris, CIO & CTO of Shake Shack. In this episode, Dave delves into how Shake Shack leverages technology to enhance customer experience and streamline operations, offering insights into the brand's forward-thinking strategies. From the digital infrastructure behind Shake Shack’s success to the ways they continue to innovate in the fast-casual space, this episode is a must-listen for anyone interested in the intersection of tech and hospitality. Be sure to tune in and hear Dave's insights on the episode as Shake Shack continues to make waves in the industry.

Tune into the episode and subscribe to our channel here: Hospitality Hangout With Dave Harris

You can tune in on:

Spotify: Click Here

Apple Podcasts: Click Here

Watch on YouTube: Click Here

Are you loving the Hospitality Hangout? Let us know! Please leave us a review here!

Transform your restaurant experience with Rockbot

Effortlessly create the perfect dining ambiance with impactful music, signage, and TV solutions that keep guests hungry for more.

TECHNOLOGY

Don’t Lose Money: Use Minimum Deal Economics to Build a Healthy Business

By: Seth Temko, Solutions Services Partner at Branded Hospitality Ventures

If you sell B2B software, understanding minimum deal economics is key to staying profitable. Here’s what it is, why it matters, and how to make it part of your sales strategy.

Elevated service, every step of the way

Call a National Accounts Representative! CALL 866.949.4504

MARKETING

What Smart Restaurants Are Planning to Do in January

By: Rev Ciancio, Head of Revenue Marketing at Branded Hospitality Ventures

You know who likes salesy content? No one. No one wants to be sold. We want value, we like offers, we want increase, we need things. But no one responds well to "HEY, BUY THIS AWESOME THING NOW!"

JOIN THE HEADLINE

Ready to showcase your ideas and insights?

Share your article with us for a chance to be featured in The Hospitality Headline!

We’re excited to spotlight diverse voices and spark meaningful discussions within our community. Submit your piece and let’s make your voice a headline!

That’s it for today!

See you next week, same bat-time, same bat-channel.

It takes a village!

Jimmy Frischling

Branded Hospitality Ventures

jimmy@brandedstrategic.com

235 Park Ave South, 4th Fl | New York, NY 10003

Branded Hospitality Ventures ("Branded") is an investment and solutions platform at the intersection of foodservice, technology, innovation and capital. As experienced hospitality owners and operators, Branded brings value to its partners through investment, strategic counsel, and its deep industry expertise and connections.

Learn more about Branded here: Branded At-A-Glance